Loans are a fundamental financial tool that allows individuals and businesses to access funds for various purposes. They enable borrowers to make significant purchases, invest in opportunities, or manage unexpected expenses. This article will explore four primary types of loans: Personal, Business, Mortgage, and Payday loans, providing readers with a comprehensive understanding of each to facilitate informed borrowing decisions.

Personal Loans

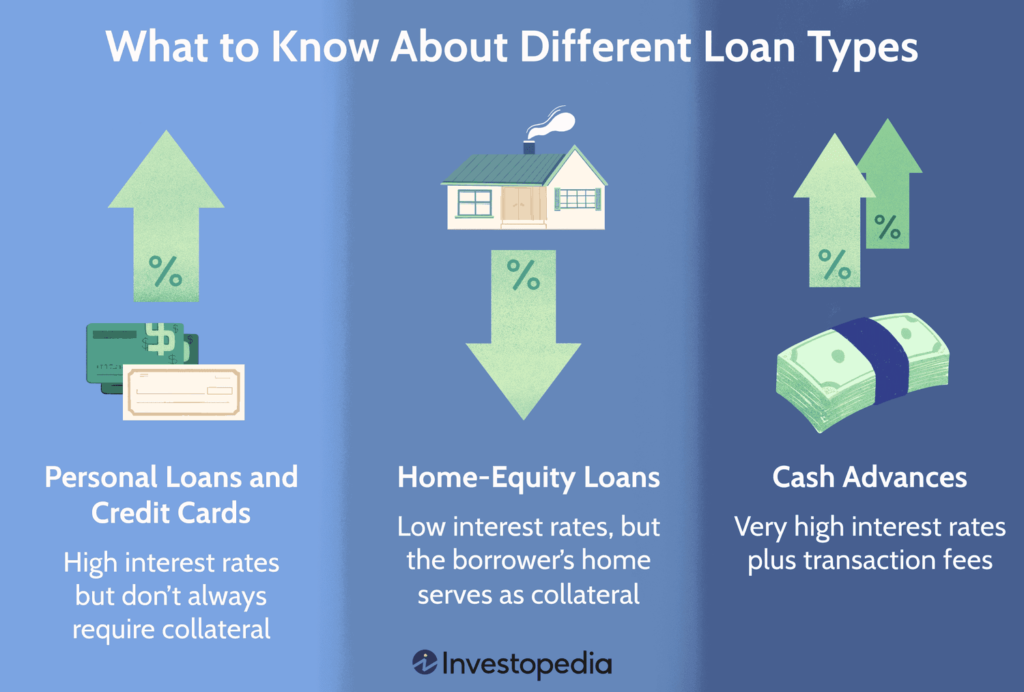

Personal loans are unsecured loans that can be utilized for a variety of purposes, including debt consolidation, home improvements, or major purchases. They typically range from $1,000 to $50,000, with repayment terms varying from one to seven years. Interest rates for personal loans can be competitive, generally ranging from 5% to 36% APR, depending on the borrower’s creditworthiness and the lender’s policies.

When applying for a personal loan, lenders assess several factors to determine eligibility. Key considerations include the applicant’s credit score, income level, and debt-to-income ratio. A higher credit score usually results in better interest rates and terms. To compare personal loan offers effectively, borrowers should focus on interest rates, any associated fees, and the flexibility of repayment options. It’s advisable to shop around and consider multiple lenders to find the most favorable terms[2][5].

Business Loans

Business loans are essential for financing operations, expansion, and growth within a company. They can take various forms, including term loans, lines of credit, and Small Business Administration (SBA) loans. Term loans are typically used for significant investments, such as equipment purchases or real estate, while lines of credit offer more flexibility for managing cash flow.

To qualify for a business loan, lenders often require a solid business credit score, a proven revenue stream, and a detailed financial history. Factors such as the business’s age, industry, and financial health also play a critical role in the approval process. When selecting a business loan, entrepreneurs should consider their specific needs—whether they require short-term cash flow support or long-term investment capital—and choose a loan type that aligns with those needs[3][4].

Mortgage Loans

Mortgage loans are specifically designed to finance the purchase of real estate. They are typically secured loans, meaning the property itself serves as collateral. There are various types of mortgage loans, including fixed-rate mortgages, adjustable-rate mortgages, Federal Housing Administration (FHA) loans, and Veterans Affairs (VA) loans. Fixed-rate mortgages offer stability with consistent monthly payments over a set term, while adjustable-rate mortgages may start with lower rates that can fluctuate over time.

Key factors influencing mortgage approval include the borrower’s credit score, the size of the down payment, and the appraised value of the property. Generally, a higher credit score and a larger down payment can lead to better mortgage terms. Navigating the mortgage process involves several steps, from obtaining pre-approval to closing on the property. Borrowers should also be aware of current interest rates and market trends to secure the best possible deal[2][3].

Payday Loans

Payday loans are short-term, high-interest loans designed to provide quick cash for emergency needs. They typically range from $100 to $1,000 and are intended to be repaid by the borrower’s next payday. The appeal of payday loans lies in their accessibility, as they often do not require a credit check. However, they come with exorbitant interest rates, sometimes exceeding 400% APR, and can lead to a cycle of debt if not managed carefully.

The risks associated with payday loans include high fees, potential rollover charges, and the likelihood of falling into a debt trap. Borrowers should consider alternatives such as personal loans, credit union loans, or borrowing from family and friends, which may offer more favorable terms and lower interest rates[2][4].

Conclusion

Understanding the various types of loans—Personal, Business, Mortgage, and Payday—is crucial for making informed financial decisions. Each loan type serves distinct purposes and comes with its own set of terms, conditions, and risks. Individuals should carefully evaluate their financial situations and consider consulting with a financial advisor before committing to any loan. By doing so, borrowers can better navigate the lending landscape and choose the options that best suit their needs.

Citations:

[1] https://study.com/academy/lesson/what-is-a-loan-definition-types-advantages-disadvantages.html

[2] https://www.lendingtree.com/personal/different-types-of-personal-loans/

[3] https://corporatefinanceinstitute.com/resources/commercial-lending/loan/

[4] https://www.mikevestil.com/entrepreneurship/types-of-bank-loans/

[5] https://www.investopedia.com/terms/l/loan.asp

[6] https://en.wikipedia.org/wiki/Microfinance

[7] https://www.personalfinancelab.com/finance-knowledge/personal-finance/short-term-financing/

[8] https://www.investopedia.com/articles/pf/07/loan_types.asp